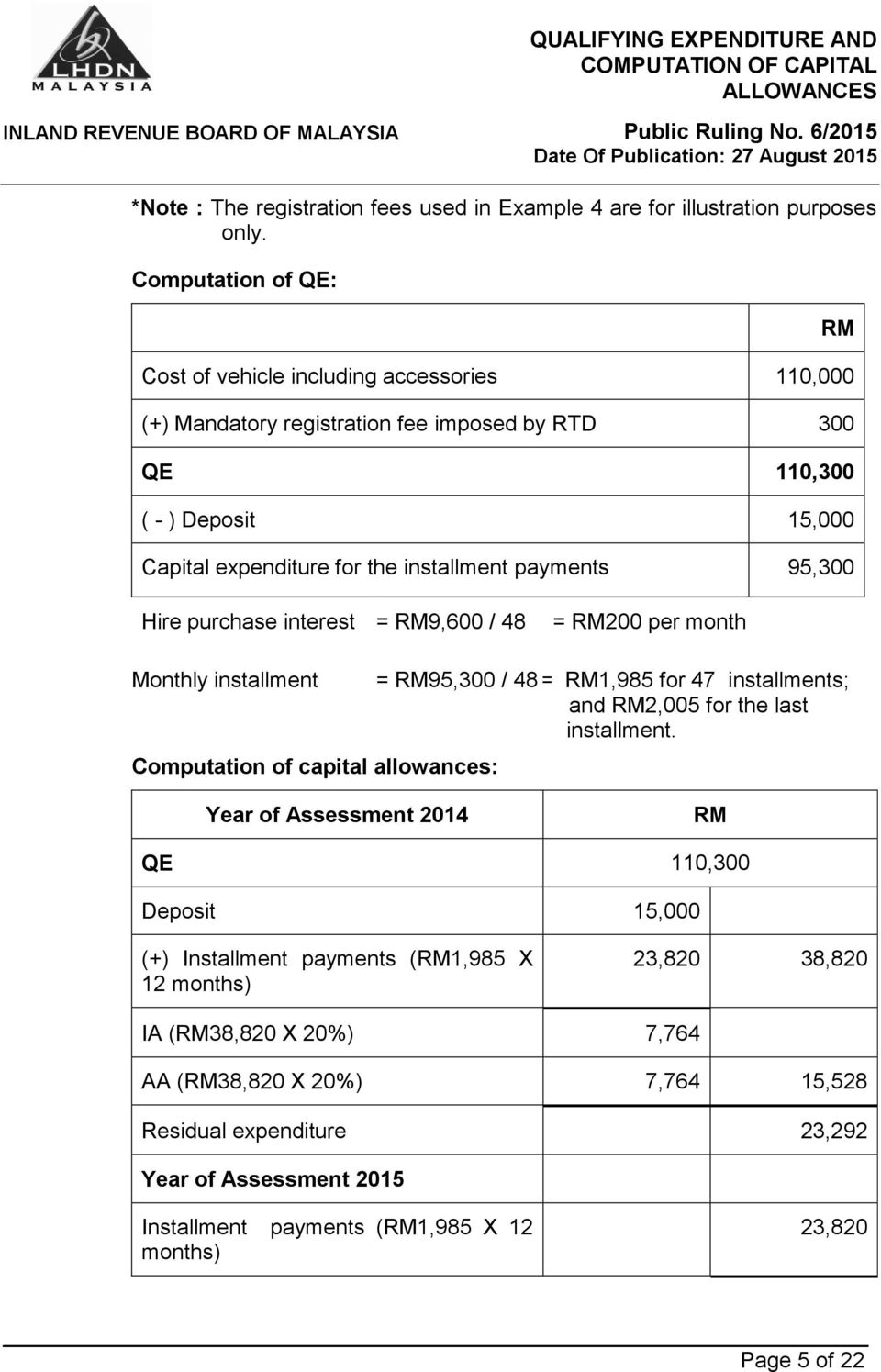

Capital Allowance Public Ruling

INLAND REVENUE BOARD OF MALAYSIA QUALIFYING EXPENDITURE AND

Malaysia's MoF has no power to restrict investment allowance claim

Malaysia - Taxation of cross-border M&A - KPMG Global

COVID-19 potential implications for the banking and capital

Malaysian Companies Solar Tax Incentives by Helmi Medium

Tax Considerations for Foreigners Investing in UK Real Estate

Ministry of Finance and Economy - income-tax

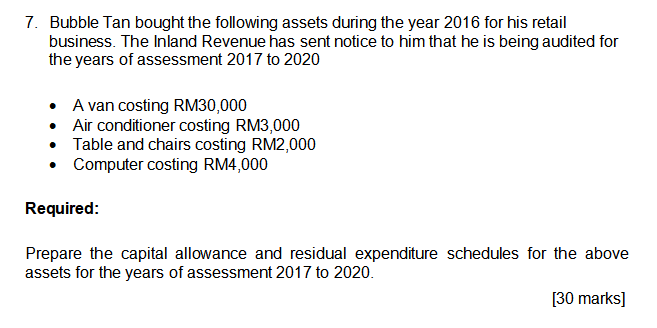

Solved 7. Bubble Tan bought the following assets during the

Agriculture Crowe Malaysia PLT

Malaysia's MoF has no power to restrict investment allowance claim

Partnership Taxation by zamrin - Issuu

Tags:

archive